In 1999, major computer software would stop to work because they only stored the last 2 digits of the year. The Y2K bug create high demand for programming skills to fix these softwares, increasing the overall valuation of software companies, especially the ones from Internet, and suddently this demand vanishes, causing the dot com bubble.

Fintech 2.0 high demmand for automating banks created high demand for programming skills, but the automations such as Mortgage Electronic Registration System couldn't verify frauds as good as a human being. The result was a bubble of junk bonds that burst and compromised the thurst on centralized institutions.

The aggressive strategy of aquisition of app companies led to exagerated valuation compared to the revenue. Everybody wanted to build an app and strike it rich. One big concern was Facebook, but it was the small companies such as Snapchat that lost 80% of value.

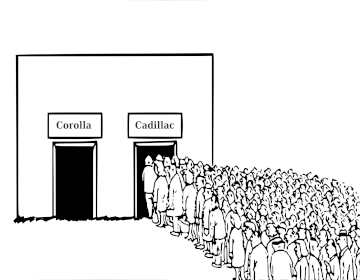

It will be the last IT bubble. The pattern will become too obvious. We will stop to care about crazy fads, and start to focus on objective arguments and professional experience just like we do when we want to buy a car and ask a thrustworthy mechanical for advice.